Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

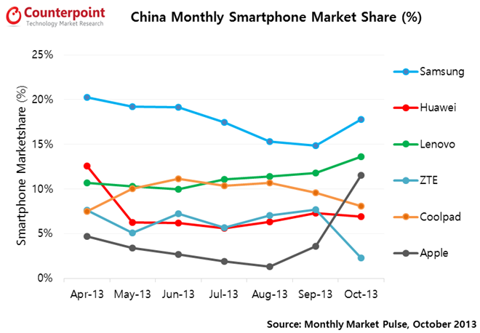

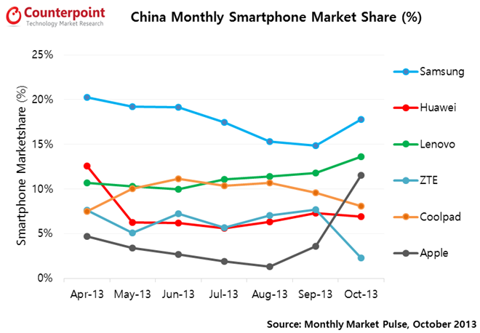

It's no secret that Apple (

AAPL) has been gaining momentum in China. Coinciding with the launch of the 5C/5S, Apple's market share in China has jumped dramatically, and

it's looking more and more like the company is not going to have any trouble monetizing the Chinese markets via its deal with China Mobile.

(Source)

(Click to enlarge)

(Click to enlarge)

And although neither company is openly admitting it, there seems to be

demonstrable evidence that Apple has reached a deal with China Mobile - with China Mobile going so far as to show a picture of on iPhone on its website. Usually, that's a dead giveaway.

A deal with China Mobile (

CHL) would open Apple up to hundreds of millions of potential iPhone buyers; more importantly, a market that Apple hasn't even begun to infiltrate. Fellow SA Contributor Trefis argues that this

could be a $45 billion opportunity for Apple - and I agree.

Which leads me to how this could catalyze a stock run through $575 that could eventually push towards $900 by 2015. Trefis notes in their article that this could push Apple to as high as $650, but I believe that once the $575 mark is broken, the next stop could be as high as $900 in the coming two years.

Apple is one of the most highly covered stocks in the history of the stock market. It's followed and analyzed almost everywhere - on all blog sites, on all financial TV networks, and across all other types of mediums - including impromptu discussions at airport urinals amongst business types.

With Apple's coverage and popularity now, it's likely that Apple is one of stocks most susceptible to the 21st century world of high speed trading.

In case you're not familiar with how things have changed over the last 20 years, the days of traders running around on the market floor executing trades have been replaced by algorithmic programs written by MIT graduates that do the thinking, trading, and executing automatically.

Now, the guys you see running around on the NYSE and NASDAQ floor in the background of CNBC, I assure you, are simply running to get their new computer overlords more coffee (to be inserted via USB 2.0 port) when the computers demand it. Otherwise, the computers might simultaneously discontinue the coffee-runner's health insurance, cancel their home heat, and make their Netflix only play non-stop 15 hour chunks of CSPAN. The machines have taken over.

We can't stop this evolution, as the sea change has already taken place. However, we can be aware of the increased importance of thinking like a machine, charting, and trying to profit from it. I've laid out in a

previous article exactly how I feel about charting:

Charting, as I often state, is a love/hate relationship. I dislike it because I don't like the notion of trading a company based on the chart without the fundamentals, but in the computerized algorithmic world of trading that exists nowadays, it's a necessary evil. You have to think like a machine in order to make moves that will preempt computerized runs and raids of stocks - and that's why I think charting is a necessary evil.

It's important to hammer home the sentiment that I use charting as a supplemental tool, and you should do the same, too. Never base decisions strictly on how a chart seems to look -- RSIs can stay oversold/bought, stochastics the same. There are no

definites with charting and technical analysis, don't forget that.

Having said that, with charting never being more popular than it is now, combined with the major coverage on Apple and the amount of money that changes hands over Apple stock on a daily basis, I think it needs to be taken into account here.

Long story short, I don't often agree with chartists, but in an article this morning on CNBC.com, I couldn't agree with Carolyn Boroden of

FibonacciQueen.com:

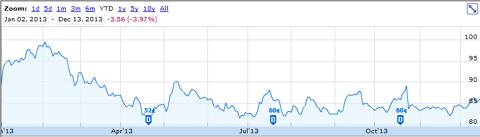

That's because $575 is a key Fibonacci level representing the 61.8% retracement of the swing from the September 2012 high to the April 2013 low.

Because Apple already tested that $575 level last Thursday, and quickly pulled back 15 points, the next pass may be a make or break moment for shareholders.

That is, if Apple breaks above $575 on its next run higher, the pattern would be considered bullish. However, if it fails, Apple would make a double top at $575, and that would be bearish. Should that happen, a correction may not be far behind.

Actually, all three chart mongers in the above mentioned

article all have their own technical reasons why Apple could be poised for an "epic" long term run. Out of the three, the $575 point was the one I had deduced on my own just yesterday before reading it here - and I couldn't agree more. What does this mean?

Here's how Apple looks today:

(Click to enlarge)

$575 could very well be the key. There will be a double top established in the short term if Apple cannot break through it. That would likely mean, at least in the short term, a pullback.

But, now onto the other scenario.

If Apple does break through $575, it'll likely head to $600, where if it forms a

cup and handle pattern, it could mean something very lucrative in the long term.

(Click to enlarge)

If Apple starts to get really bullish again, this multi-year chart shows you just, exactly, how Apple could very well be on its way to $900 in the coming years.

(Click to enlarge)

So, there's quite a bit to watch here with Apple over the coming weeks. Is there a chance that $575 is going to be the key to unlock all of this? If Apple continues to perform well as a company and grows in China as expected, then yes. However, I'll reaffirm all of my previous caveats about charting. I only feel comfortable using it in this instance because I know that Apple is as fundamentally sound as companies come. With the question of the fundamentals securely behind me, I can then confidently move on to supplemental methods of analysis, like charting.

Long term, I remain bullish on Apple no matter what the chart outlook is. The company remains a great long-term bet with its dividends and growth potential in China - as well as its continued growth potential in items like Mac, where it still has major market share to capture.

Best of luck to all investors.